Patterns are the distinctive forms made by the price prices of a security on a chart. A pattern is indicated by a line that connects specific price points, such as closing prices, highs, and lows, throughout a particular time.

Chartists attempt to recognise patterns to forecast the future direction of a security's price. Patterns serve as the basis for technical analysis.

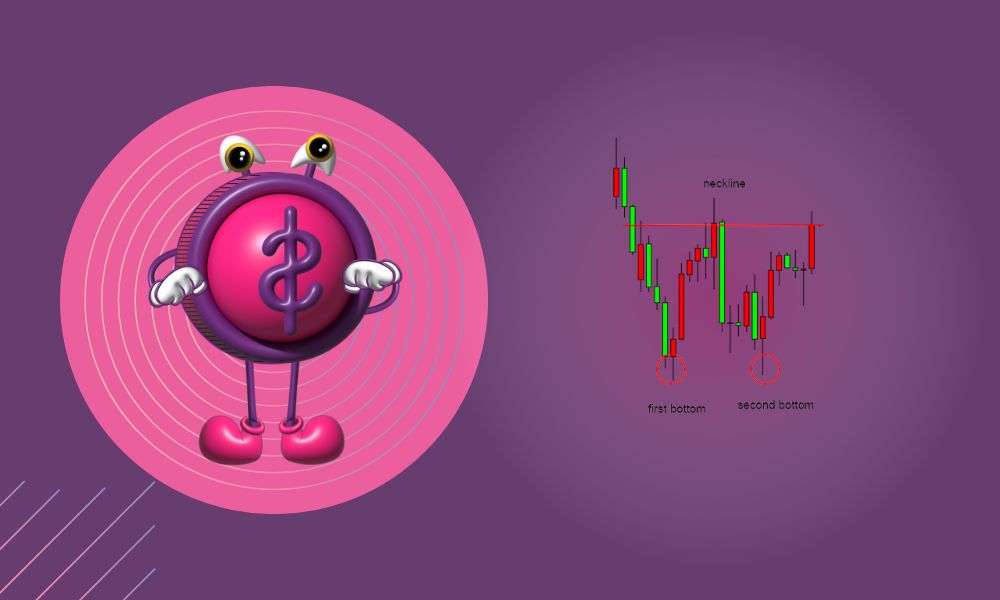

In technical analysis, a double-bottom pattern is a time-honoured charting structure that identifies a significant shift in the trend and a reversal in momentum following a previous decrease in market activity.

It explains the fall of a security or index, its subsequent recovery, a subsequent fall to the same or comparable level as the initial fall, and a final rebound (that may become a new uptrend).

The double base resembles the letter "W" in its shape. It is now well recognised that the low that was touched twice is an important support level. There is a new possibility for a price increase as long as these two lows remain intact.

According to a conventional interpretation of the pattern, the price target for the minimum possible advance is equivalent to the distance that separates the two lows from the intermediate high.

When shooting for more aggressive targets, double the distance between the two lows and the intermediate high.

In the technical analysis of financial markets, a double bottom is notable because it indicates that a substantial low or strong level of support has been reached after a decline.

Price action is anticipated to demonstrate a retracement higher and may signal the commencement of a fresh uptrend as long as the double bottom remains intact.

Similarly, a decline below the double-bottom lows in succeeding periods indicates that the downtrend is resuming and the bears have regained the upper hand.

As with many other chart patterns, a double bottom pattern is best suited for intermediate- to long-term market analysis.

For the reason above, it is preferable to utilize daily or weekly data price charts when evaluating markets for this specific pattern.

The double bottom pattern always follows a big or minor downtrend in a particular security, indicating a potential reversal and rise. The pattern should be validated by a shift in market fundamentals for the security itself (such as improved profitability), its sector, and the market as a whole.

The fundamentals must reflect the features of a forthcoming market reversal. Moreover, volume must be closely checked throughout pattern development.

A volume spike often happens throughout the pattern's two upward price movements. These volume surges strongly indicate upward price pressure and further validate a genuine double-bottom pattern.

Once the closing price is in the second rebound and is reaching the peak of the first rebound of the pattern ("W"), market conditions are ripe for a reversal, as seen by an increase in volume and fundamentals.

On a daily close above the price level of the high of the first rebound, a long trade should be initiated with a stop loss at the second low in the pattern. The lowest measured movement target for the pattern is the distance between its two lows and its intermediate high.

A more aggressive interpretation of the pattern would imply a target double the distance between the lows and the intermediate high.

Advanced Micro Devices' daily price chart depicts a double bottom in the context of an overall downturn (AMD). After a sudden, sharp decrease, the first low is met with substantial buying interest, resulting in a long, thin candlestick and a bullish engulfing line (if you are also utilizing candlestick analysis, these are both bullish reversal patterns).

The succeeding high is roughly 10% above the initial low, indicating that investors should be on the lookout for a further decline at this time, as rebounds from initial lows normally range between 10% and 20%.

Top THREE Award-Winning Brokers in 2022 Top THREE Award-Winning Brokers in 2022  LiteFinance |IC Markets|Exness |

The second low of the pattern comes within 3% to 4% of the previous low, supporting the pattern's validity. A level of substantial support has been achieved and tested twice, so traders should anticipate a possible correction higher or possibly a fresh uptrend now that the second bottom has been established.

Upon a dip below the double bottom lows, the pattern is invalidated and downside potential restarts. A daily close above the intermediate high, on the other hand, indicates a dramatic reversal and maybe the start of a new uptrend.

Double bottom formations are particularly effective when correctly spotted. However, when incorrectly perceived, they can be highly harmful. Therefore, one must exercise considerable caution and patience before drawing conclusions.

The indicator to watch for is a second bottom near the previous low, followed by bullish confirmation in future time frames, such as days or weeks. These patterns are most evident on daily and weekly charts.

A double bottom is symbolic of a change in trend and the possible beginning of a new upswing. In terms of buyers and sellers, the sellers have generated a downtrend that reached a support level, resulting in a rebound or short-covering.

The subsequent bounce is considered corrective within the general downtrend, indicating that sellers are still present and will eventually make another attempt to push prices lower.

However, the previous low/support level manages to hold once again, indicating that the underlying fundamentals may have altered and the selling pressure may be spent, putting the sellers suddenly on the wrong side of the downward movement.

Read More From StreetCurrencies:

EUR/USD Technical Analysis And Trading Strategy For The Day -StreetCurrencies

Walmart Targets Young Shoppers With Roblox Experiences -StreetCurrencies

FP Markets Won "Best Global Value Broker" At The 2022 Global Forex Awards. -StreetCurrencies